Household monetary belongings, together with financial institution deposits, money and fairness investments, after deducting debt servicing and consumption, eased to five.1% of gross home product within the fiscal yr ended March from 7.2% within the earlier yr, in response to the most recent information from the Reserve Bank of India.

That degree, in response to calculations by IndusInd Bank Ltd.’s Chief Economist Gaurav Kapur, is the bottom for the reason that fiscal yr ended March 2007, and can crimp assets for the remainder of the economic system. India’s authorities depends upon these savings to finance capital investments on bodily belongings akin to infrastructure, equipment and tools.

While savings elevated for a lot of households globally through the pandemic, most used up the resultant further spending energy as Covid curbs ended. That contributed to the restoration of economies the world over, and partly, to larger inflation.

India’s personal client price-growth, which has remained above the Reserve Bank of India’s 2%-6% goal vary for 14 of the previous 20 months, has stored inflation-adjusted actual wages stagnant, lowering the power of households to avoid wasting. Falling family savings can slender the avenues out there to the federal government to plug its funding hole, say economists.

“Household financial savings not keeping pace with growth is a matter of concern”, mentioned Saugata Bhattacharya economist at Axis Bank Ltd. “Without adequate domestic savings, funding the needed investment will require large foreign capital, which is often volatile.”

For now, India’s GDP is projected to develop 6.1% within the present fiscal yr ending March, making it the quickest tempo amongst main economies. To maintain that world-beating title, India must maintain funding spending, and never simply depend on debt-fueled non-public consumption as an engine of growth.

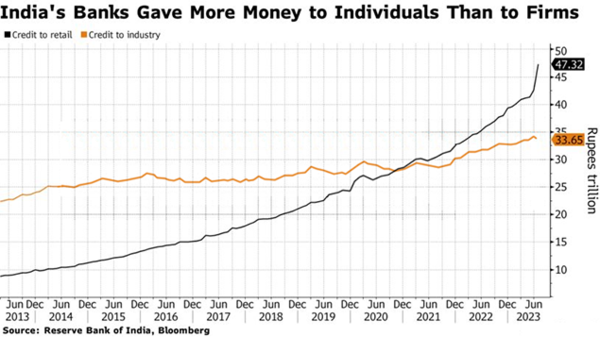

More than 300 million Indian households have seen debt ranges enhance following aggressive lending ways by banks after the pandemic. Record low charges provided to fulfill pent-up demand doubled banks’ retail mortgage portfolio between 2019 and now, build up some misery within the course of. Credit card spent hit a file excessive of 1.47 trillion in May.

The rise in monetary liabilities with falling belongings ranges could possibly be an indication of rising inequality.

“The household sector is consuming by borrowing more,” mentioned Rupa Rege Nitsure economist with L&T Finance Holdings Ltd. “This happens when income level stays stagnant but inflation creeps up. The recovery is not broad-based — while a section splurges on luxury goods, others are borrowing to stay afloat.”