Loan EMIs: After RBI MPC’s choice to cut repo rate, authorities officers are actively maintaining an eye on banks and lenders to guarantee rate reductions introduced by the central financial institution are correctly transmitted to prospects. A high-ranking authorities official indicated they will have interaction with banks if the rate cut transmission just isn’t evident within the coming weeks.

“There is no stipulated timeline. Each bank’s asset-liability committee will take a call, but it should not be the case that there is no, or very marginal, benefit passed on,” he informed ET.

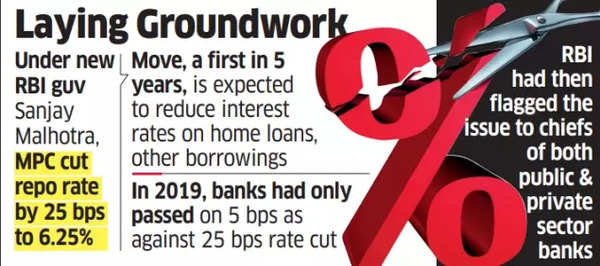

The RBI introduced a 0.25 share level repo rate discount final week, the primary such lower in 5 years, doubtlessly main to decrease rates of interest on housing loans and different credit score amenities.

Under new RBI governor Sanjay Malhotra, the MPC decreased the repo rate to 6.25%.

RBI repo rate cut

“The MPC remains unambiguously focused on a durable alignment of inflation with the target while supporting growth,” Malhotra stated.

In 2019, following a 25-basis-point discount by the central financial institution, most banks solely handed on about 5 foundation factors, necessitating a gathering between the RBI and banking establishments.

Also Read | Loan EMI calculator after RBI MPC meet: Bonanza for center class! How a lot will you save with decrease EMIs + new revenue tax slabs? Explained

The earlier RBI governor, Shaktikanta Das, had then emphasised the importance of rate transmission publish rate cuts and indicated plans to talk about crucial measures with banks.

Previously, the central financial institution highlighted inadequate financial transmission as an important coverage difficulty, noting its impression on limiting coverage effectiveness concerning financial exercise and inflation.

An Emkay Global Financial Services evaluation signifies that while the system liquidity deficit has decreased to ₹70,000 crore presently, it “will turn ugly” reaching past ₹2.5 lakh crore by March-end with out further measures.

“This implies that more measures are on the anvil if the RBI finds this level of deficit uncomfortable for policy transmission, especially as the depth of the cut cycle is still arguable,” it famous. The evaluation suggests the repo rate discount will have an effect on margins (5-12 bps) for banks with increased floating or repo-linked loan portfolios.