US President Donald Trump has framed his sweeping tariff coverage as important for defending American staff and manufacturing, selling it as a cornerstone of his “America First” agenda.Since returning to workplace this yr, the Trump administration has overseen a historic surge in tariff collections. According to Fox Business, complete obligation income reached $215.2 billion in Fiscal Year 2025 (ending September 30). October alone introduced in a file $34.2 billion. The Treasury additionally already reported $41.6 billion in tariff income in Fiscal Year 2026, and since Trump unveiled his “Liberation Day” tariffs in April, month-to-month collections have climbed sharply—from $23.9 billion in May to $29 billion in July, with August and September collectively including $62.6 billion.

Trump’s logic was– tariffs elevate the price of imported items, encouraging producers to relocate manufacturing to the United States whereas producing substantial authorities income. However, examination of financial knowledge and evaluation from world-leading establishments reveals a basic contradiction between Trump’s claims and the results unfolding within the American financial system.

The financial logic of tariffs: Examining the inspiration

At the core of Trump’s tariff technique is the assumption that overseas producers will shoulder a lot of the value. But the financial mechanics of tariffs hardly ever work that method. A tariff is, basically, a tax on imports — and until overseas exporters aggressively lower costs, which occurs solely to a restricted extent, a lot of the burden shifts inward. Economists name this tax incidence, the real-world distribution of who finally ends up paying as soon as markets regulate. In in the present day’s globalised provide chains, the place imported parts sit inside every part from electronics to equipment, the incidence is overwhelmingly pushed down the chain.That sample has been evident for months. Even in mid-2025, when the distribution appeared barely totally different, Americans had been nonetheless paying the overwhelming share of tariff prices, in accordance to Goldman Sachs.US shoppers absorbed about 22 per cent, whereas American companies carried roughly 64 per cent, leaving overseas exporters with solely 14 per cent. But the burden is projected to tilt much more closely towards households by year-end. According to the estimates from earlier this yr, US shoppers are seemingly to shoulder round 55 per cent of tariff prices, with American corporations taking over 22 per cent. Foreign exporters’ contribution rises solely modestly to about 18 per cent, reflecting the restricted extent to which they lower costs. The remaining 5 per cent falls into routing changes and different leakages somewhat than any identifiable group escaping the tax. The bottomline is– regardless of political claims that tariffs make overseas producers pay, the financial weight has all the time landed — and can proceed to land — totally on Americans themselves. The pass-through mechanismThe Federal Reserve’s real-time evaluation of 2025 tariffs gives definitive proof of how prices move by the financial system. The Federal Reserve Board examined tariffs carried out in February and March 2025 on imports from China and located that tariffs handed by absolutely and shortly to client items costs inside two months of implementation. Their theoretical evaluation predicted {that a} 10 percentage-point tariff enhance on imports from China raises client costs throughout a wide range of items classes, with a big share of products classes experiencing at the least a 1 % worth enhance following such a tariff change.By August 2025, the Federal Reserve Bank of St. Louis quantified the cumulative impact: tariffs accounted for 0.5 share factors of headline PCE annualized inflation and 0.4 share factors of core PCE annualized inflation between June and August 2025. When measured over the 12-month interval ending August 2025, tariffs explained 10.9% of headline PCE annual inflation.Former IMF Deputy Managing Director Gita Gopinath instantly addressed Trump’s tariff technique in October, stating that whereas tariffs have “significantly boosted government revenue,” the positive factors have come “largely at the expense of domestic firms and households hitting American businesses and consumers.” She famous particularly that tariffs have “contributed to higher prices, burdening households,” with prices rising “in several everyday consumer items” together with “household appliances, furniture, coffee.“Yale Budget Lab’s complete evaluation of all 2025 tariffs discovered that client costs rise 1.2% within the short-run, equal to a mean per family earnings lack of roughly $1,700 in 2025 {dollars}. This worth enhance represents a switch of wealth from American shoppers and companies to the federal authorities by tariff income assortment.

Scenario evaluation simplified: What occurs when tariffs are imposed

As we discuss who bears the actual burden of the tariffs, it is also necessary to perceive the fundamentals of what occurs when tariffs are literally imposed as per the foundations of economics.Scenario 1: Buyers settle for larger costsThis has certainly been the dominant sample. Yale Budget Lab’s July 2025 evaluation discovered that 2025 tariffs disproportionately have an effect on clothes and textiles, with shoppers going through 40% larger shoe costs and 36% larger attire costs within the short-run, with costs remaining 19% and 17% larger within the long-run respectively. The impression is regressive: lower-income households spend bigger shares of earnings on these necessities, which means tariffs operate as a consumption tax that falls heaviest on these least in a position to take in worth will increase.The Federal Reserve’s most well-liked inflation gauge rose to 2.6% in June, up from 2.4% in May, with core inflation rising to 2.8%—instantly contradicting claims that tariffs would not elevate costs.Scenario 2: Buyers scale back consumption & financial uncertainty emergesThe San Francisco Federal Reserve’s evaluation of 40 years of worldwide tariff knowledge discovered that following tariff will increase, the unemployment fee will increase by roughly 10 foundation factors for each 1 share level enhance in tariff charges. This implies that given Trump’s tariff will increase averaging 20-50 share factors on main buying and selling companions, unemployment could be anticipated to rise 0.5-0.6 share factors—a considerable financial impression.Importantly, the evaluation reveals that tariffs act initially as a requirement shock—uncertainty causes shoppers and companies to scale back spending, which quickly suppresses inflation whereas rising unemployment. However, this dynamic reverses: “Over time, the economy adjusts: The unemployment rate returns to its original level or even declines slightly, whereas inflation picks up and peaks three years after the initial change in tariffs, relative to the scenario where tariffs remain unchanged.“

Coffee exposes actuality?

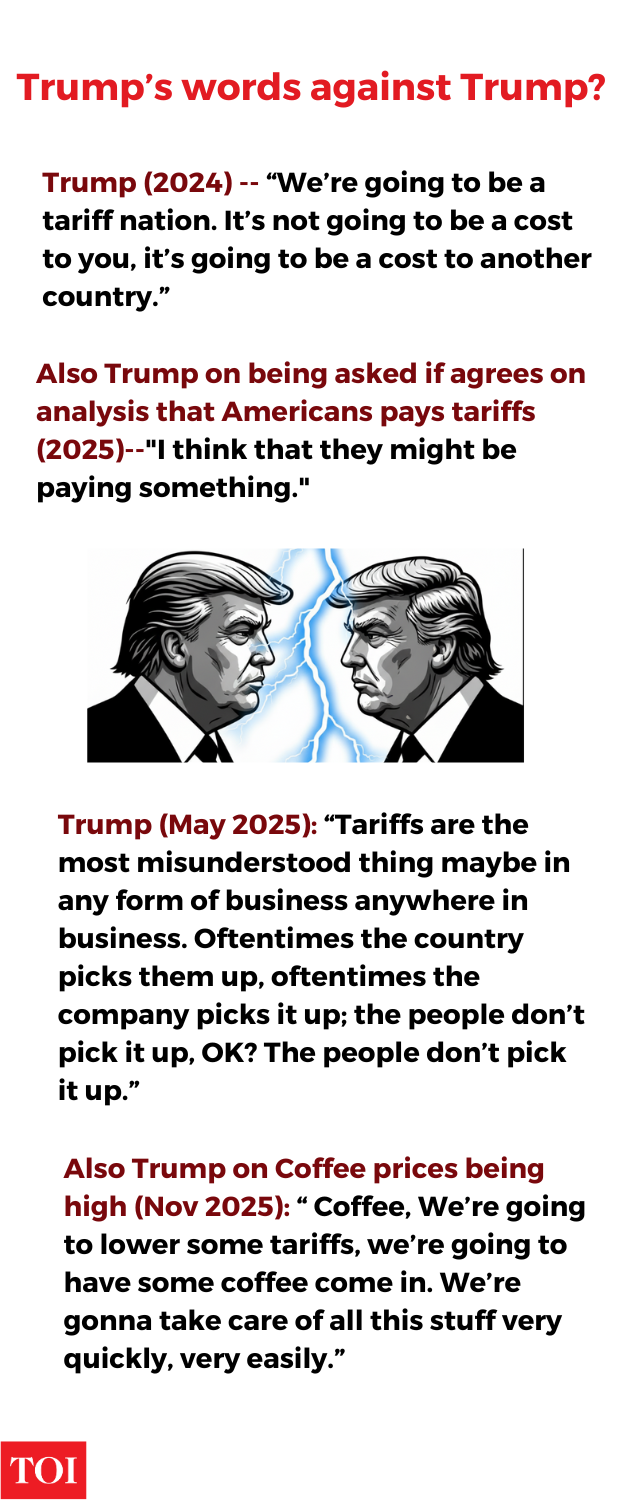

Trump, who has lengthy claimed that tariffs don’t harm American shoppers, ended up acknowledging the other — and his newest coverage transfer proves it even additional. When Fox News host Laura Ingraham not too long ago identified that espresso costs are excessive, Trump stated he would “lower some tariffs” to convey costs down “very quickly.”That admission grew to become actuality quickly after, when the White House rolled again tariffs on greater than 200 meals merchandise — together with espresso, beef, bananas and orange juice — following rising public frustration over hovering grocery payments. Coffee, which is nearly solely imported, has seen costs soar roughly 15 per cent since January, in accordance to CNN, partly due to Trump’s personal sweeping tariffs imposed earlier this yr.By suggesting that slicing tariffs will scale back costs — after which issuing a sweeping set of exemptions that took impact retroactively — Trump has inadvertently conceded that tariffs operate like taxes that elevate prices for Americans. This contradicts years of his rhetoric insisting that “foreign countries pay” and that his duties don’t gasoline inflation.Economists, companies, and a number of research have lengthy proven that US importers pay tariffs and sometimes go these prices on to shoppers. Even Treasury Secretary Scott Bessent stated the administration expects costs for gadgets like espresso and bananas to fall as soon as tariff reductions are introduced. Time will inform whether or not corporations reverse the will increase.

This was not the one latest contradiction. Just a few days earlier than the “coffee price admission”, Donald Trump acknowledged that American shoppers “might be paying something.” The comment got here after a reporter cited Chief Justice John Roberts’ description of tariffs as taxes paid by Americans. Though Trump insisted the US nonetheless “gains tremendously,” his remark quantities to a uncommon admission that tariffs do elevate prices for shoppers — contradicting his earlier statements insisting “foreign countries pay”.

The provide chain complication: Intermediate items

When American corporations import parts from overseas to assemble merchandise domestically, they now pay tariffs on these inputs. A World Bank evaluation analyzing the US-China commerce struggle demonstrated that tariffs on imports of Chinese upstream intermediate items negatively have an effect on US downstream exports, output and employment. The results are significantly extreme in US industries that rely closely on focused intermediate items.This creates a cascade of value will increase. When corporations face tariffs on inputs important for manufacturing—semiconductors, metal, or automotive parts—they’ve restricted capability to substitute domestically, amplifying value pressures all through the financial system. The Federal Reserve’s June 2025 Monetary Policy Report acknowledged this dynamic, noting that “input cost pressures were widespread in manufacturing and retail, largely reflecting tariff-induced increases.“

The Contradiction: How Trump claims costs are happening whereas inflation goes up

Trump administration officers have claimed that tariffs aren’t driving inflation, pointing to particular knowledge suggesting sure metrics have declined. This assertion requires cautious interpretation primarily based on the timing of tariff results found by rigorous financial analysis.The San Francisco Federal Reserve’s evaluation of historic worldwide knowledge reveals that tariffs initially create a unfavorable demand shock that quickly suppresses inflation at the same time as costs for tariffed items rise. The mechanism operates as follows: Uncertainty about future commerce coverage causes corporations to delay funding and shoppers to scale back spending. This demand contraction creates downward strain on total worth ranges that may quickly masks the upward strain from larger tariff prices. Foreign exporters, going through diminished demand, might decrease their costs to keep market share.However, this can be a short-term phenomenon lasting roughly 1-2 years. Subsequently, inflation surges as supply-side pressures dominate. The San Francisco Fed discovered that inflation “peaks three years after the initial change in tariffs.” The administration’s statements about steady or declining costs seize knowledge from early 2025—the demand-shock section—whereas ignoring the cost-push inflation that follows.This timeline is vital for understanding the financial logic: instantly after tariff will increase, weak demand might suppress total inflation even whereas particular items costs rise. But this represents financial contraction, not success. Americans scale back consumption not as a result of they select to however as a result of they face financial uncertainty and potential job losses. The value comes later within the type of persistent, elevated inflation years 2-3 after tariff implementation.

The income story: Government positive factors, however financial system loses More

Tariff revenues have surged in latest months. According to Fox Business, the US collected a file $34.2 billion in October alone. Total tariff receipts reached $215.2 billion in fiscal yr 2025, and the Treasury has already reported $41.6 billion in collections to this point for fiscal 2026.Since Trump unveiled his “Liberation Day” tariffs, month-to-month revenues have climbed sharply — rising from $23.9 billion in May to $29 billion in July, whereas August and September collectively generated $62.6 billion. Trump has repeatedly highlighted these figures, arguing that tariff revenues — now at historic highs — may finance his proposed one-time $2,000 dividend for low- and middle-income households.Yale Budget Lab’s evaluation quantifies this tradeoff: whereas all 2025 tariffs elevate authorities income, they concurrently scale back client welfare and financial output greater than the income collected. As of November 2025, Yale estimates the short-run per-household earnings loss at roughly $1,700, with the post-substitution impact settling at a $1,300 loss per family.Furthermore, Trump’s promise of $2,000 dividend funds faces a basic arithmetic drawback. The Tax Foundation estimated that Trump’s new tariffs would elevate solely $158.4 billion in 2025 and $207.5 billion in 2026. But checks restricted to tax filers with incomes under $100,000 may value $279.8 billion—already exceeding two years of projected income. Expanding funds to embrace non-filers may push prices to $606.8 billion, practically double the anticipated 2025–26 tariff income.

Bottomline

The knowledge factors overwhelmingly in a single course: tariffs operate as a tax on Americans, not on overseas rivals. As mounting proof exhibits costs rising at the same time as Washington information historic income, Trump’s technique exposes a deeper dilemma — whether or not a coverage can stay politically well-liked whereas imposing rising financial prices on the very households it claims to shield.How the administration navigates that contradiction might decide not solely the trajectory of the financial system but additionally the sturdiness of its “America First” financial narrative.