By Shailesh Agarwal, Partner – Risk consulting, EY India

Railway Budget 2025 expectations: Indian Railways, a state-owned enterprise below the Ministry of Railways, operates the fourth largest nationwide railway system globally, with 132,310 km of tracks. It employs over 1.2 million individuals, making it the world’s ninth-largest employer. Established in 1951 by merging 42 railway corporations, it manages 18 zones. Indian Railways operates an unlimited network of categorical, passenger, and freight trains, carrying billions of passengers and hundreds of thousands of tonnes of freight yearly. It additionally manufactures its personal rolling inventory, together with electrical and diesel locomotives.

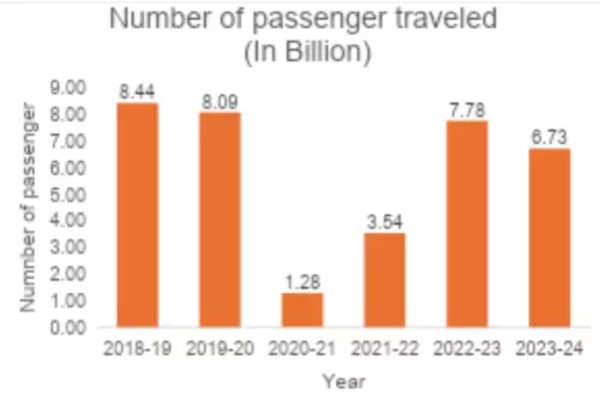

Number of Passengers Travelled

Indian Railways’ income primarily comes from passenger fares, freight prices, and different non-fare sources like promoting, station redevelopment, and leasing of railway land. Freight transport, being extra worthwhile, contributes a good portion of the income. In the fiscal 12 months 2022-23, freight visitors accounted for round 60% of the entire income.

Expenditure, alternatively, is substantial, together with prices for gasoline, upkeep of tracks, rolling inventory, stations, salaries of staff, and pension liabilities. The operating bills are excessive due to the huge network, infrastructure wants, and subsidies supplied for passenger fares. Despite efforts to improve effectivity and enhance non-fare revenues, Indian Railways faces monetary pressure, with a excessive operating ratio indicating that a big share of its income is spent on operational prices.

Also Read | Railway Budget 2025: Indian Railways to deal with fashionable trains, upgraded stations & tracks – particulars right here

Railway’s income from numerous sources and outlay is as follows:

*Chart compiled and analysed by EY India

The operating ratio of Indian Railways, a key monetary metric, displays the proportion of income spent on operating bills. Historically excessive, it was round 98% in 2022-23. To improve this, Indian Railways is specializing in rising freight income, modernizing infrastructure, and enhancing non-fare income sources.

YoY Operating ratio of Indian railways has moved in following trajectory:

*Chart compiled and analysed by EY India

In-depth comparability of income v/s expenditure highlights that Indian railway has by no means been ready to meet operational bills of passenger companies with the income it generates. Below is YoY losses of passenger companies vis-à-vis revenue of freight companies which is getting cross backed:

Loss on passenger vs revenue on freight service

Source: CAG report 2023

Further evaluation of income expenditure provides us extra perception:

*Chart compiled and analysed by EY India

As can be seen from the under desk, the loss on passenger and different teaching companies has been steadily rising through the years from 2017-18 to 2020-21 however decreased throughout the 12 months 2021-22.

Intervention required from Government pertaining to the railway sector:

An enormous, aged, unanswered query stands in entrance of us is how we as a nation can repair these poor operation ratios. The knowledge above clearly highlights the broad motion factors. Summary of the identical is as follows:

1. Currently the federal government is majorly specializing in passenger companies that are in loss as in contrast to freight companies which are extra worthwhile as in contrast to passenger companies. MoR can have a look at rising passenger fares in accordance with the precise price of service. The Ministry of Railways (MoR) can take queues from cellular operators and MoRTH. Services are reasonably priced but scale can also be being managed.

2. The income expenditure of railways in 2021-22 for the employees and pension was 69%. It’s necessary to reap the benefits of know-how to optimise the manpower price of the entire income spent by MoR

3. Other necessary actions e.g.

- Closing down traces the place the visitors earnings are lower than preserving these traces operating;

- Reducing halts for trains at small stations one additional halt for a prepare will increase the gasoline consumption by between 1-2%

- Stop investing cash in uneconomic ventures e.g. electrification of traces which isn’t economically justified

The Indian authorities and MoR ought to ponder over the potential for quick monitoring Public-Private Partnership (PPP) initiatives to foster non-public investments. PPP is a confirmed mannequin which has labored nicely within the Indian state of affairs. Like MoRTH, MoR can replicate the success of PPP fashions we have now seen within the freeway sector below NHAI, unlocking progress alternatives within the rail sector.

India vs. China: A Comparative Snapshot

To higher perceive the challenges and alternatives forward, it’s helpful to examine Indian Railways with China’s railway network. Although China’s railways at the moment outperform India’s in a number of areas, together with network dimension and high-speed rail, India’s rising infrastructure, technological innovation, and dedication to modernization maintain immense potential for narrowing this hole.

While China’s rail network is extra superior, India’s ongoing reforms and strategic investments in high-speed trains, station redevelopment, and freight infrastructure counsel that India is well-positioned to improve its rail capabilities considerably.

Conclusion

Indian Railways stands on the cusp of a serious transformation, pushed by innovation, infrastructure growth, and sustainability. The ongoing efforts to modernize the railway system, together with the anticipated allocation of funds within the Union Budget 2025, will play an important position in shaping the way forward for rail journey in India. With developments in know-how, infrastructure, and security measures, the following decade guarantees to witness a leap within the modernization of Indian Railways, making it safer, sooner, and extra sustainable.

(The writer, Shailesh Agarwal, is Partner – Risk consulting, EY India. Ajay Jindal, senior advisor, EY India additionally contributed to the article)