MUMBAI: Availability of credit for taxes paid on inputs – be it items, resembling uncooked materials, or providers for setting off in opposition to Goods and Services Tax (GST) legal responsibility performs an vital position within the GST area. Input tax credit (ITC) helps scale back the tax outgo for the GST payer.

A retrospective modification, which comes into impact from July 1, 2017, debars entities, resembling commercial actual property companies from claiming ITC on building prices for his or her rental buildings.

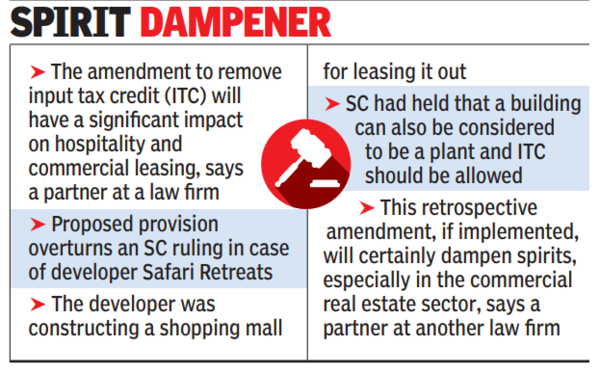

Rohit Jain, deputy managing associate, at Economic Laws Practice mentioned, “The proposed amendment restricts the eligibility of ITC of goods and services used for construction of immovable property on ‘one’s own account’, such as building, warehouses and any other civil structure. The amendment has a significant impact on hospitality and commercial leasing activities.”

Any retrospective modification denying the profit to taxpayers at giant is rarely obtained properly by the business and is considered as a retrograde and regressive step. The identical is in opposition to the spirit of stability and predictability and has the potential to woo away the buyers, added Jain.

The proposed provision overturns a SC judgement within the case of Safari Retreats, an actual property developer, who was developing a shopping center for leasing it out. The SC had held {that a} constructing can be thought of to be a plant and ITC needs to be allowed.

A slight distinction in terminology issues loads in tax legal guidelines. Section 17 (5) of the GST Act defines a listing of purchases (inputs) on which GST is paid, however the purchaser can not declare ITC. The SC had distinguished between the phrases plant ‘or’ equipment used on this part from the time period plant ‘and’ equipment. The finances retrospectively replaces the wording ‘plant or equipment’ with the phrases ‘plant and equipment’ – following a advice of the GST council.

Sudipta Bhattacharjee, oblique tax associate at Khaitan & Co mentioned, “This retrospective amendment, if implemented, will certainly dampen spirits, especially in the commercial real estate sector in India. But, this amendment only deals with one of the two favourable conclusions of the Supreme Court in the Safari Retreats case. The legal arguments based on the Supreme Court’s interpretation of ‘construction by the taxpayer on his own account’ will remain untouched and undiminished by this retrospective amendment. This may be strongly relied upon by business in commercial real estate or infrastructure space to avail input tax credit.”

“In the past SC decisions have affirmed that vested rights accrued in favour of a taxpayer cannot be retrospectively revoked through an amendment. On this ground, the possibility of taxpayers challenging the budget proposal cannot be ruled out,” mentioned Jain.