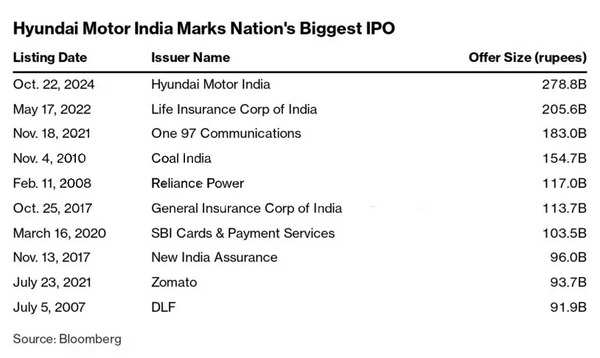

Hyundai Motor India Ltd shares slipped nearly 6% early in their Mumbai debut, a tepid begin to buying and selling for what was the nation’s largest-ever preliminary public providing.

The shares traded as little as 1,844.65 rupees after they have been priced at 1,960 rupees, the highest of the marketed vary. South Korea’s Hyundai Motor Co offered a 17.5% stake in its native unit in the IPO, searching for to profit from the investor frenzy for share gross sales in India — one of many world’s most vibrant venues for listings this 12 months.

Hyundai Motor India, the nation’s second-largest carmaker by gross sales, was valued at about $19 billion in the IPO. Some noticed the shares as expensive, with Bloomberg Intelligence analyst Joanna Chen noting the valuation was about 5 instances its Korean dad or mum’s, although in line with these of Indian friends equivalent to Maruti Suzuki India Ltd.

While the providing was finally oversubscribed greater than two instances, book-building was slower than some had anticipated. Hyundai’s deal noticed robust demand from establishments, which flooded in on the final day of sale. Retail traders, nevertheless, solely purchased about half the portion that had been reserved for them in the IPO.

Individual merchants have been turned off by the dad or mum firm getting the entire IPO proceeds in addition to cooling demand in India’s auto business, analysts have stated. The poor retail curiosity stands in distinction to the frenzy seen in some latest IPOs, significantly smaller points.

‘Long-term value’

Hyundai’s preliminary decline makes it an outlier provided that enthusiasm for Indian share gross sales has usually carried over to their post-listing efficiency. New listings in the nation have risen by a mean of 39% in their first buying and selling day this 12 months, in response to information compiled by Bloomberg. Among IPOs of over $500 million, the typical acquire was 66%.

Some analysts are constructive on the inventory’s long-term prospects.

“Hyundai Motor India’s IPO offers potential long-term value, but it is not suited for investors seeking quick gains,” Devi Subhakesan, an analyst at Investory Pte, wrote in a notice on Smartkarma forward of the debut. “Valuation risks are expected” amid shifting client preferences and rising competitors in India’s auto business.

India’s emergence because the world’s fastest-growing main financial system in addition to its increasing center class current a possibility for automakers. The nation’s automobile market is on monitor to achieve 20 million items by 2047, Suzuki Motor Corp. Executive Vice President Kenichi Ayukawa stated in an interview in July. A complete of 4.2 million passenger autos have been offered in India in the fiscal 12 months ended in March, in response to the Society of Indian Automobile Manufacturers.

Nomura Holdings Inc initiated protection with a purchase ranking forward of the itemizing, citing expectations for “healthy” quantity progress and car worth will increase. It set a worth goal of two,472 rupees, implying a possible upside of about 26% over the IPO worth.

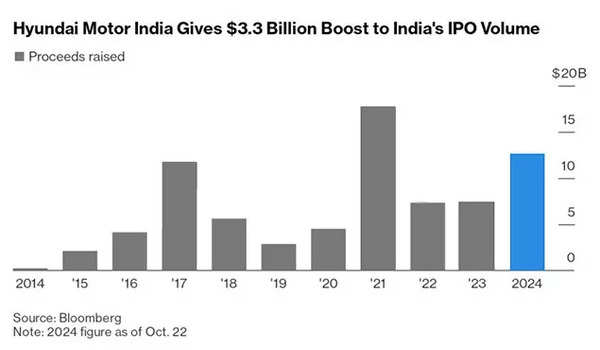

With Hyundai’s proceeds, Indian IPOs have raised greater than $12 billion up to now this 12 months, eclipsing volumes for the previous two years however nonetheless under the record $17.8 billion raised in 2021, in response to information compiled by Bloomberg. Other pending debuts embrace food-delivery firm Swiggy Ltd. and the renewable-energy arm of state-run energy producer NTPC Ltd.

Around 20 corporations from Asia Pacific are itemizing shares this week in offers which will increase greater than $8 billion, the largest weekly quantity since April 2022, in response to information compiled by Bloomberg. Shares of Japan’s Tokyo Metro Co are scheduled to begin buying and selling on Wednesday after a $2.3 billion providing.