In a column in ET, Amrita Farmahan, the CEO of Ambit Global Private Client says that gold has proven regular returns of mid to excessive teenagers over the final 1, 3, 5, and seven years. Over the previous 5 years, gold has even outperformed the Nifty 50, with a Compound Annual Growth Rate of 18%. It has matched Nifty returns within the final 5 years.

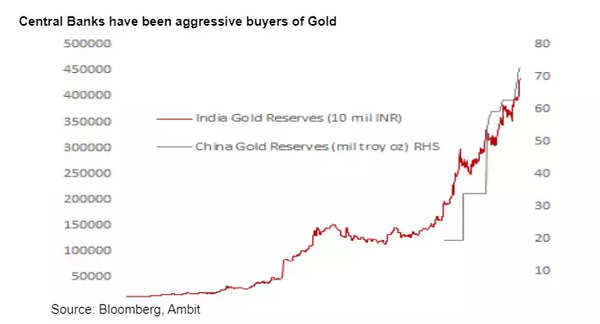

Several international traits additional bolster the funding thesis for gold. Central banks, together with these of China, India, and Russia, are steadily rising their gold reserves. According to Farmahan, the belief in greenback belongings was shaken when the U.S. froze greenback belongings on account of sanctions on Russia. Without one other foreign money choice, central banks from varied nations like China, India, and Russia are actively rising their gold reserves. Gold is turning into the popular selection for central banks, and their shopping for reduces the gold accessible out there.

ALSO READ | What is 24 karat gold? Know distinction between 999 vs 995 fineness gold

Another issue pushing up the worth of gold is the numerous quantitative easing (QE) measures, together with rising debt and curiosity burdens within the U.S. and Europe, she says.. Last year, U.S. debt elevated by $3.1 trillion, whereas authorities income stood at round $4.5 trillion yearly. Interest funds on debt reached roughly $870 million. Over the previous 20 years, U.S. debt as a proportion of GDP has risen sharply from 55% to 122%. Additionally, the follow of cash printing is anticipated to persist. Gold serves as a protected haven asset amid issues of foreign money debasement, she provides.

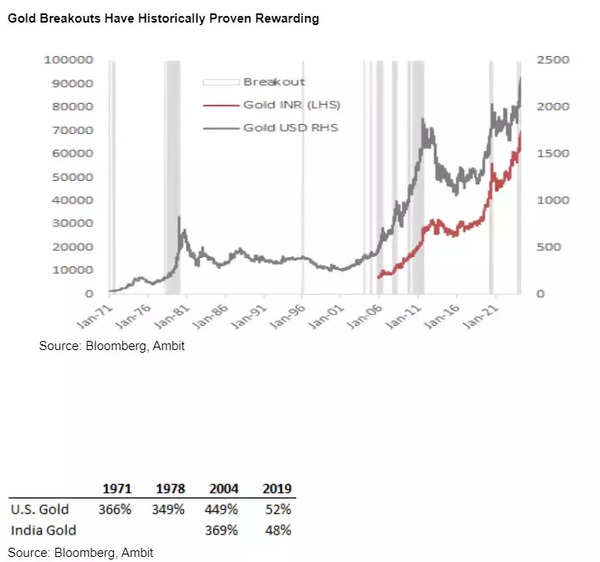

In the previous, gold costs surged when the Fed funds price peaked in 2000, 2006, and 2019. These peaks in rates of interest signaled financial weak spot and prompted the implementation of QE. Given the anticipated peak within the Fed funds price and present indicators of weakening U.S. information, one other spherical of QE appears possible. If this occurs, gold costs are more likely to rise as soon as extra, she says.

One extra small development is Chinese retail investors transferring their cash from actual property and shares to gold. It’s anticipated that U.S. retail investors will do the identical finally. Currently, belongings in U.S. Gold ETFs are down by a third from their highest level. Critics might query gold’s lack of standard earnings like money flows or dividends. However, gold has been valued for 1000’s of years, indicating its enduring enchantment. This means that the risk-reward steadiness for investing in gold is interesting, she provides.

Gold broke out of its common buying and selling vary in early March. This breakout marks the fourth important breakout since 1971, with the earlier ones occurring in 1971, 1978, 2004, and 2019. Each of those breakouts has resulted in rewarding returns for investors.

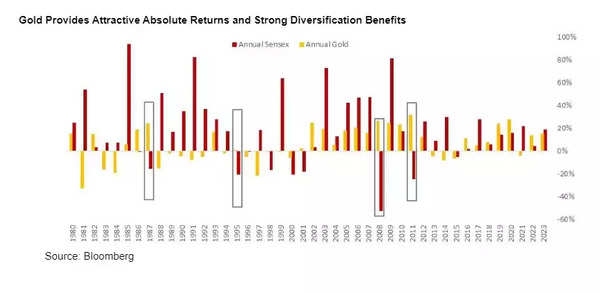

In 2002 and 2019, gold noticed will increase on account of expectations of quantitative easing. Similarly, present actions in gold costs mirror issues about debt, quantitative easing, and the vulnerability of the U.S. greenback. Additionally, gold serves as a beneficial hedge in portfolios in opposition to equities, because it sometimes performs effectively when shares decline, offering investors with sturdy returns throughout bear markets, she says.

ALSO READ | Why is RBI shopping for gold? Reserve Bank of India purchases practically 13.3 tonnes of gold in Jan-Feb 2024

Farmahan is of the view that having gold in your portfolio decreases volatility whereas providing interesting returns. For instance, through the monetary disaster of 2008, gold surged by 26% whereas shares plummeted. Similarly, in 2011, gold rose by 31.7% amidst a bear marketplace for equities. Even in 2020, amid struggles within the inventory market, gold elevated by 28.0%. Over the 2000s, whereas the S&P 500 skilled a slight annual decline of 1%, gold noticed a median annual improve of 14%. These cases exhibit gold’s monitor file of delivering sturdy returns and counsel it could proceed to take action sooner or later.

When it involves allocating belongings, one of the best portfolio contains a mixture of investments that do not transfer in sync. It’s even higher in the event that they transfer in reverse instructions, so if one, like shares, is not doing effectively, others can steadiness it out. Gold suits this technique completely. We suggest a 10% allocation to gold for moderate-risk investors. The most popular solution to put money into gold is thru Gold ETFs and Sovereign Gold Bond Funds, she concludes.