Gold vs Silver buying: Silver presents a sexy choice for aggressive traders searching for portfolio diversification and alpha era past conventional equities, consider analysts. Despite the current surge in home prices, which noticed silver attain the Rs 1 lakh per kg mark, analysts recommend that traders consider allocating 3-5% of their portfolio to the white metallic by buying on dips over the following 1-3 months.

Since the start of the calendar 12 months 2024, silver has skilled spectacular beneficial properties, rising by 33.65% to the touch the Rs 1 lakh per kg mark.In the previous month alone, it has gained 12.5%, outperforming the Nifty 50 index, which returned 12.5% through the calendar 12 months however misplaced 5.6% over the previous month.

In greenback phrases, silver’s efficiency has been much more exceptional, with beneficial properties of 47.25% and 13.56%, respectively, over the identical intervals.

Vishnu Kant Upadhyay, AVP-Research and Advisory at Master Capital Services, attributes the growing market worth of silver to its in depth use in numerous industries.

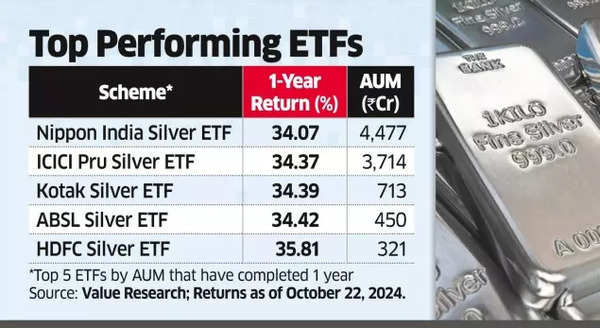

Top Performing Silver ETFs

(*1*)Rising industrial demand, excessive home imports, ETF buying by traders and Fed fee cuts have been supportive for silver.”

While acknowledging the possibility of profit-booking following the sharp rally, Modi advises investors to view major dips as buying opportunities. He projects that silver could reach Rs 1.25 lakh per kg over the next 12 months.

As advancements in technology continue and the need for electronic devices and semiconductors grows, the demand for silver is expected to remain strong, leading to a sustained upward trend in prices.

Bhavesh Jain, co-head of Hybrid and Solutions Funds at Edelweiss Asset Management, stated, “Silver has seen a powerful long-term bullish break; the development may probably proceed supported by decrease charges for longer and the revival in Chinese industrial exercise.” Jain suggests that investing in silver ETFs is a more convenient option for investors compared to purchasing physical silver.

Also Read | Looking to beat fixed deposit returns? Here’s what investors can consider instead of FD

However, some fund managers believe that the long-term prospects of silver will be influenced by the adoption and adherence to climate change and green technology initiatives by major global economies.

Vikram Dhawan, head of commodities and fund manager at Nippon India Mutual Fund, explained, “If traders consider in Earth’s rising temperature drawback and its penalties, silver can serve as a proxy hedge.”

Nirav Karkera, head of research at Fisdom, advises, “Aggressive traders may purchase on each fall and allocate 5-15% of their portfolio to the white metallic.”

Dhawan identified that within the brief time period, silver prices could also be affected by a Republican victory within the US, as Donald Trump just isn’t recognized for his environmentalist stance and as a substitute favors fossil fuels.

Considering the anticipated volatility, the upcoming US elections, and uncertainty concerning additional fee cuts by the Federal Reserve, wealth managers advocate that traders consider staggering their silver purchases.