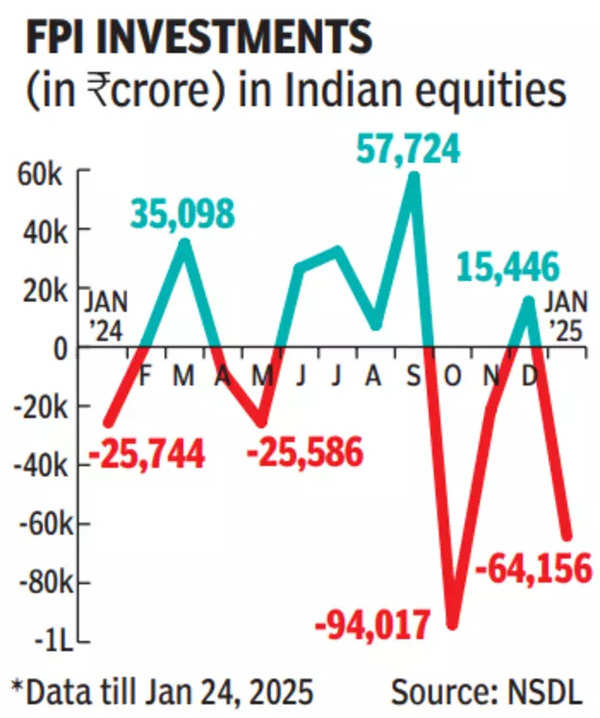

NEW DELHI: The exodus of Foreign Portfolio Investors (FPIs) from the Indian fairness markets continues unabated, as they’ve withdrawn Rs 64,156 crore ($7.44 billion) to date this month, pushed by the depreciation of the rupee, an increase in US bond yields, and expectations of a tepid earnings season.

This comes after an funding of Rs 15,446 crore in Dec, based on information from depositories. The shift in sentiment displays a mixture of world and home headwinds. “The continued depreciation of the Indian rupee is exerting significant pressure on foreign investors, leading them to pull money out of the Indian equity markets,” stated Himanshu Srivastava, Associate Director – supervisor analysis, Morningstar Investment Advisers India.

Additionally, the excessive valuation of Indian equities -despite latest corrections, the expectation of a subdued earnings season, and macroeconomic challenges-are making buyers cautious, he added. Moreover, the unpredictable nature of Trump’s insurance policies has prompted buyers to tread cautiously, steering away from riskier funding avenues, he famous.

According to the information, FPIs offered shares value Rs 64,156 crore in Indian equities this month (as much as Jan 24). Notably, FPIs have been internet sellers on all days this month besides Jan 2. “The sustained strengthening of the dollar and the rise in US bond yields have been the principal factors driving FPI selling. As long as the dollar index remains above 108 and the 10-year US bond yield stays above 4.5%, the selling is likely to continue,” stated V.Okay. Vijayakumar, chief funding strategist, Geojit Financial Services.