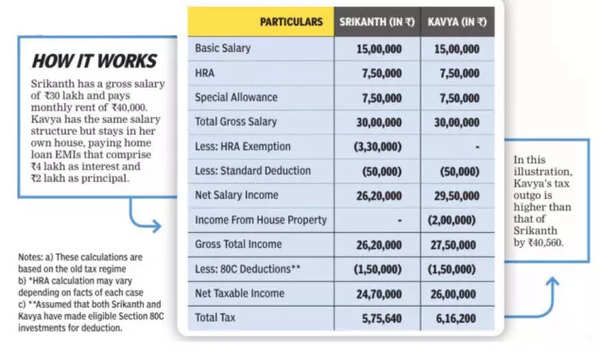

Is it higher to remain on hire or get your individual place? It’s sophisticated, to borrow a phrase from romantic conundrums. So, ought to one spend a large sum on a home property – particularly with the assistance of a home mortgage – on condition that costs are larger and the capital appreciation in lots of cities just isn’t as vital because it as soon as was? Isn’t dwelling on hire, maybe nearer to the workplace, simpler? On the opposite hand, an funding in a home property is a secured and tangible funding.Plus, a home isn’t just 4 partitions; there’s a lot of emotion hooked up to it. Let’s have a look at it from the tax perspective…

Renting a home

One of the most important benefits of renting a home from a tax perspective is the exemption for home hire allowance (HRA), a tax-efficient wage element. If HRA just isn’t a a part of your wage package deal — for instance in case you are self-employed or a guide— you’ll be able to avail deduction of as much as 5,000 a month from gross taxable

revenue, underneath the outdated tax regime. The HRA exemption just isn’t out there to taxpayers who go for the brand new tax regime. The exemption is on the bottom of the next:

● Rent paid much less 10% of wage (primary wage and dearness allowance)

● 50% of wage if the home is in Delhi, Mumbai, Kolkata or Chennai, or 40% of wage in different cities

● Actual HRA obtained

Other execs

● Rent could also be decrease than a home mortgage EMI

● More selection of location and sort

● Easy to relocate to a different space of metropolis

● Tax advantages can be found (underneath outdated tax regime)

Cons

● Rent, nonetheless excessive, doesn’t go in direction of creating an asset

● Rents often improve yearly, resulting in larger money outflow

● No or restricted scope of constructing structural modifications

● One could need to vacate on brief discover

Buying a property

Tax advantages are solely out there underneath the outdated tax regime. If you’re taking a home mortgage to buy a home property, the EMI is often made up of two components: one half goes in direction of the principal (the quantity you took as mortgage) and the opposite in direction of the curiosity (the price of servicing the mortgage).

On principal reimbursement: Deduction is offered underneath the general 1.5 lakh restrict underneath Section 80C underneath the outdated tax regime. Principal reimbursement, stamp obligation, registration price and different bills associated to switch of the home property qualify for the deduction, underneath this restrict.

On curiosity paid: Three conditions apply: the home is self-occupied, vacant or rented out. For a self-occupied home property, there’s deduction out there on the curiosity paid on home mortgage as much as 2 lakh every year underneath the outdated tax regime. This may be set off towards some other revenue. The similar guidelines apply even when the home is vacant. If you’ve rented out the home, you’ll be able to declare deduction for not solely the curiosity paid on the home mortgage, but additionally municipal taxes paid and a customary deduction of 30% of the rental revenue.

Set-off and carry ahead of loss: If your own home is a self-occupied property purchased utilizing a home mortgage, it means you don’t earn any rental revenue from it. Therefore, curiosity paid on the home mortgage will end in a loss. Total loss as much as 2 lakh from home property (both self-occupied or letout) may be adjusted in a monetary 12 months towards some other head of revenue (similar to wage or revenue from different sources). Loss exceeding 2 lakh may be carried ahead for eight subsequent evaluation years however may be setoff solely towards ‘Income from house property’.

Notional hire: The idea of notional hire applies when a person owns three homes or extra. In such instances, two home properties are thought-about self-occupied (with none circumstances as per the 2025 Budget proposals) and the remaining are handled as ‘deemed let-out’, thus attracting notional hire. This is predicated on the anticipated market hire and turns into a taxable revenue.

Pros:

● A home is an asset and EMIs go in direction of creating this asset

● Substantial tax advantages on home loans

Cons:

● Heavy upfront prices similar to down cost and registration, adopted by property taxes and repairs

● House properties are illiquid as they can’t be offered shortly

● Property costs see fluctuations and will not fetch anticipated returns

● EMIs need to be paid recurrently, largely no matter conditions like lack of revenue