MUMBAI: Brands are chasing India’s 377 million Gen Zs – that is greater than all the US inhabitants – as many be a part of the workforce, including to the cohort’s share of complete spends.

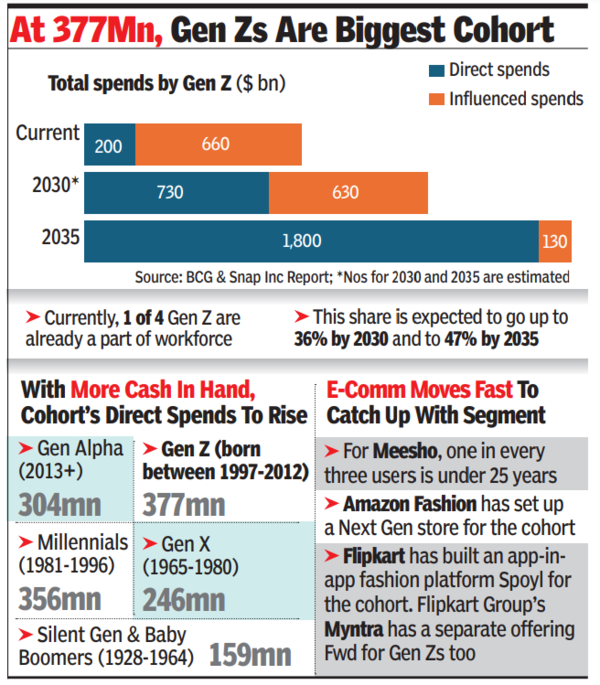

Already, Gen Zs (people born between 1997-2012) affect a good portion of a family’s consumption basket, at the moment driving 43 per cent or $860 billion of complete shopper spends, in keeping with a BCG and Snap Inc report.Of this, about $200 billion comes from their very own earnings whereas $660 billion is influenced spends (by households however the selection of product is influenced by Gen Zs). Estimates counsel that by 2030, about 36 per cent of Gen Zs could be within the workforce, driving $730 billion of direct spends and $1.4 trillion in all – motive sufficient for manufacturers to take observe and strategise.

“The preferences, behaviours and aspirations of Gen Zs are reshaping industries and we are designing our business strategy with them at the core… we are prioritising personalisation, affordability and durability – key factors Gen Z value in their purchases,” Aman Gupta, co-founder and chief advertising officer at BoAt informed TOI. He added that the section is predicted to account for a large share of the model’s revenues inside the subsequent 3-5 years. This will partially be helped by means of wearable tech of their every day lives.

E-commerce majors Amazon and Flipkart have additionally been transferring quick of their quest for catching the Gen Zs younger, establishing separate shops for the cohort inside their platforms. While Amazon Fashion has a Next Gen retailer for Gen Zs, Flipkart has constructed an app-in-app trend platform Spoyl for the younger buyers. Flipkart Group’s Myntra has a separate providing Fwd for Gen Zs too.

In truth, Gen Zs being digital natives are the fastest-growing section in e-commerce. For Meesho, as an illustration, one in each three customers is below the age of 25 years, an organization spokesperson stated. Zeba Khan, director of trend & magnificence at Amazon India, claimed that the corporate has seen a 3 times soar in its Gen Z buyer cohort following the shop launch. “India’s diverse demographics pose a challenge for fashion brands targeting Gen Z… price sensitivity is a key factor with a significant portion of the population which seeks value for money and affordable options,” Khan stated. Nimisha Jain, senior associate and managing director at BCG, stated that the cohort’s affect (when it comes to shopper spending) cuts throughout classes starting from trend to cars and shopper durables.

For Gen Zs, developments rating over manufacturers, making the job harder for firms to maintain them hooked. Homegrown wearable model Noise is investing closely in know-how to raise the general expertise for Gen Zs, stated co-founder Gaurav Khatri. “They are quick to dismiss brands that feel disconnected or overly commercial. This requires us to stay agile, constantly innovating our products. As a matter of fact, they are empowering both the millennials and Gen Alpha with the knowledge of technology and need for lifestyle solutions,” he added.

Titan’s Fastrack is introducing sub-brands and launching focused campaigns to get extra Gen Z buyers. The model’s head of promoting Danny Jacob stated that its latest product launches just like the Fastrack Fleek, Gambit collections and model Vyb have bolstered the corporate’s revenues.