MUMBAI: Stocks noticed heavy selloff on Tuesday and indices just like the sensex closed decrease for the fifth consecutive session weighed in by weak international and home cues.

As US President Donald Trump escalated the commerce struggle with like-for-like tariffs on iron and aluminium imports, traders felt jittery globally. The weak point of the rupee, which confirmed some restoration in the course of the day, and steady promoting by international funds, additionally dampened market sentiment, brokers and analysts stated.

As a consequence, the sensex remained within the crimson from the beginning of the day’s session and closed 1,018 points or 1.3% decrease at 76,294 points. On the NSE, Nifty noticed an identical path and closed 310 points or 1.3% decrease at 23,072 points. In the final 5 classes, the sensex has misplaced practically 2,300 points or 3%.

Foreign traders, like up to now a number of weeks, led the promoting on Tuesday as nicely that left traders poorer by Rs 9.3 lakh crore with BSE’s market capitalisation at Rs 408.5 lakh crore, alternate information confirmed.

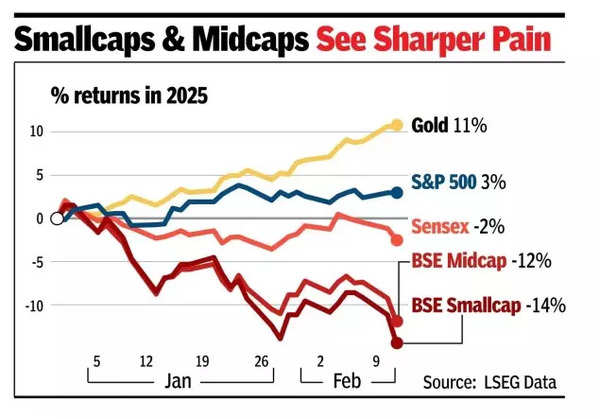

“The ongoing uncertainty surrounding US trade policies and tariffs, coupled with domestic economic growth concerns and persistent selling by FIIs, is dampening market sentiment, said Vinod Nair, head of research, Geojit Financial Services. “The mid- and small-cap shares skilled vital declines attributable to demand issues and better valuations,” he said.

On Tuesday, while the blue-chip heavy sensex and Nifty each closed 1.3% lower, BSE’s smallcap index lost 3.4% and the midcap index 2.9%. On the sectoral front, real estate, industrial and healthcare stocks were the most affected. All the sectoral indices on the BSE closed in the red.

Foreign funds continued to lead the day’s selling with a net outflow from the stock market at Rs 4,486 crore, BSE data showed. Although domestic funds were net buyers at Rs 4,002 crore, they were no match for the selling by foreign investors.

Of the 30 sensex stocks, only one – Bharti Airtel – closed higher. Among the ones that closed lower, Reliance Industries, HDFC Bank and L&T contributed the most to the index’s slide.

In the broader market, 3,533 stocks closed lower compared to 479 that closed with gains. Going forward, in the short term, “traders are anticipating the PM’s go to to the US for any potential reduction in commerce uncertainty, whereas the US inflation information later in the present day (on Tuesday) will even be a key focus,” Nair stated.