The tax division has renewed its concentrate on simplification and is banking on belief. In an interview to TOI, chairman of the Central Board of Direct Taxes (CBDT) Ravi Agrawal says he’s assured that direct tax revenues would stay strong, making it simpler for the division to meet this 12 months’s goal. Excerpts:

CBDT is now the main target as evident from Budget announcement. How do you see this?

It’s a matter of nice satisfaction that this time the Budget has been taken so positively and the taxpayers are comfortable. If taxpayers are comfortable, we’re comfortable.

Given the uncertainty and slowdown within the economic system, how do you see the income numbers?

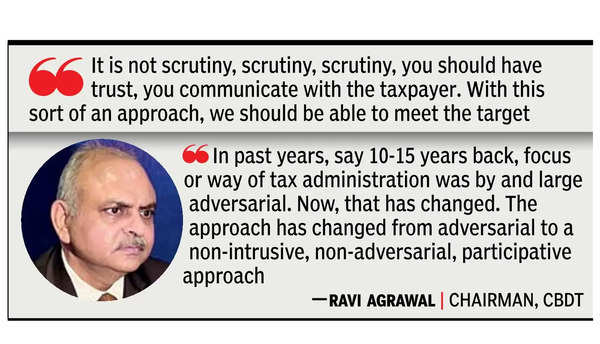

The total profit is about Rs 1 lakh crore and the Budget goal this 12 months is Rs 22.37 lakh crore, so it makes 5% of whole taxes. Therefore, the variety of taxpayers is extra. Ultimately, affect of this Rs 1 lakh crore being within the fingers of individuals will have an effect on the economic system. Business would develop. Once that’s constructive, then the economic system additionally grows. Once it grows, it has a constructive implication on tax revenues. So, it should come again. It will come via corporations, it should come via enterprise revenue, it could come via salaries as a result of if corporations develop, salaries would additionally develop. There can be a constructive spin-off of this Rs 1 lakh crore reduction. We at the moment are rising at 15% this 12 months due to this reduction and the Budget goal is stored at 12.46%. Therefore, there’s a margin of about 2-2.5%, which we’ve factored in.It will not be scrutiny, scrutiny, scrutiny, you need to have belief, you talk with the taxpayer. With this kind of an strategy, we must always have the option to meet the goal.

Now, 1 crore taxpayers will profit after the Budget announcement. What can be whole variety of taxpayers?

There are two elements. One is to avail this profit, the taxpayer has to file a return after which if a refund is due that individual would take the refund. Therefore, the variety of returns would by and enormous stay the identical. That can be about 9 crore. The rebate was accessible to Rs 7 lakh revenue and beneath, now it is Rs 12 lakh. One can say, for a crore-and-a-half taxpayers, who had been on this bracket (Rs 7 lakh to Rs 12 lakh), it will be a zero-tax legal responsibility. The precise variety of taxpayers can be round 3 crore.

How has strategy of the tax division modified with regard to the taxpayer?

We are adopting a special strategy altogether. Revenue is a part of the economic system’s progress. It will not be to be seen in isolation. It has to have a supportive function as a result of any tax is principally a by-product of the revenue or the financial exercise. So, it has to be in concord with financial progress. And, if economic system grows, tax buoyancy can be there. That issue can be there. In previous years, say 10-15 years again, the main target or means of tax administration was by and enormous adversarial. Now, that has modified. The strategy has modified from adversarial to a non-intrusive, non-adversarial, participative strategy. I’ve given some message to my officers throughout the division. We are literally working in direction of adopting a prudent strategy.

Focus of the tax division has been on simplification and a brand new invoice will likely be launched to revamp the IT Act. What are the adjustments?

It can be simplification when it comes to language, simplification when it comes to presentation and the thought behind is it is a 1961 Act. You discover at instances that the articulation, sentences should not so user-friendly, they aren’t simple and make it tough for the taxpayer to really comprehend the provisions. Due to this, there’s some kind of confusion and there’s some kind of hitch on a part of the taxpayer. Perhaps that dissuades the taxpayer from compliance. That leads to litigation. Keeping that in thoughts, the try is we rephrase these sections in simple English language in order that it’s simple for individuals to comprehend. It brings extra readability to the system and subsequently it should scale back litigation. Size of the doc has considerably come down.