MUMBAI: Loans written off by business banks between FY15 and FY24 totalled Rs 12.3 lakh crore. Of this, 53% or Rs 6.5 lakh crore of the write-offs have been by public sector banks in the last 5 years (FY20-24), in keeping with knowledge supplied by govt in response to Parliament queries.

The mortgage write-offs by the banking sector peaked in FY19 at Rs 2.4 lakh crore, which adopted an asset high quality evaluation that started in 2015. It fell to the bottom stage of Rs 1.7 lakh crore in FY24 which was just one% of complete financial institution credit score of round Rs 165 lakh crore excellent at the moment. Public sector banks presently have a share of 51% of the banking sector’s incremental credit score, decrease than 54% in FY23.

Pankaj Chaudhary, minister of state for finance, stated that in keeping with RBI knowledge, gross NPAs of public sector banks and personal sector banks as of Sept 30, 2024 have been Rs 3,16,331 crore and Rs 1,34,339 crore, respectively. Further, gross NPAs as a proportion of excellent loans was 3.01% in public sector banks and 1.86% in personal sector banks.

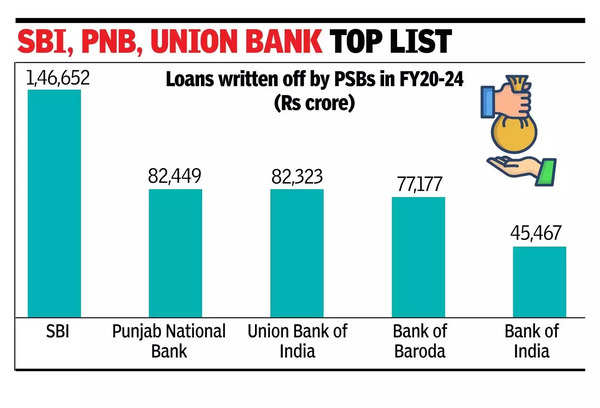

SBI, which accounts for round a fifth of banking exercise, wrote off Rs 2 lakh crore in the course of the interval. Punjab National Bank wrote off Rs 94,702 crore price of loans amongst nationalised banks. During the present fiscal as much as end-Sept PSU banks have written off Rs 42,000 crore of loans as towards Rs 6.5 lakh crore for the previous 5 years.

Responding to the question on PSB write-offs, Chaudhary stated: “Banks write-off NPAs in respect of which full provisioning has been made on completion of 4 years, in keeping with RBI tips and coverage permitted by banks’ boards. Such write-off doesn’t end result in waiver of liabilities of debtors and due to this fact, it doesn’t profit the borrower and banks proceed to pursue restoration actions initiated in these accounts.

He added that the restoration strategies embrace submitting of a swimsuit in civil courts or in debt restoration tribunals, motion beneath the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, submitting of circumstances in the National Company Law Tribunal beneath the Insolvency and Bankruptcy Code, 2016, by way of negotiated settlement/ compromise, and thru sale of NPAs.

Govt, in a separate assertion, stated that public sector banks in India recorded their highest-ever combination internet revenue of Rs 1.41 lakh crore in FY24. This was supported by an enchancment in asset high quality, with the gross NPAs ratio declining to three.12% in Sept 2024. In the primary half of 2024-25, PSBs reported a internet revenue of Rs 85,520 crore.